Binary options trading is being seen more and more as one of the ways to make money online. One of the great benefits to binary options is that it takes low capital requirements to get started. Unlike other types of trading accounts, which can take up to $10,000-$25,000 in start-up capital just to get started, with binary options you can regularly start at $250 or less when starting out.

But even before beginning to trade with real money, it is highly recommended that one start with demo trading first before anything else. If one lacks a competent trading strategy, money management plan, and the right mindset before beginning to trade, then each deposit made is going to be wasted rather quickly.

With that said, is it technically possible to turn $250 into $1,000,000? Of course. And by taking on minimal risk as well. It all largely comes down to the the power of compounding, which can be amazing when seen and implemented in practice.

But again, it also takes a lot of talent, money management skill, and the proper psychological fortification against the emotional fluctuations that trading can bring as well.

There are six variables that must be taken into consideration when determining how fast a certain amount of money can be compounded into a larger quantity:

Table of Contents

1) The initial sum

This is important, but not supremely so. For purposes of showing how the process of compounding goes over time, I’m more concerned about ratios over anything else. For example, turning $250 into $1,000,000 would entail building that sum to 4,000 times its initial amount.

So if you started out with $10, that would come out to $40,000. If you started with a higher amount, say $1,000, that would come to $4,000,000.

But I’m less concerned with the starting amount as I am with demonstrating how compounding can build a massive profit ratio. It’s just that “one million dollars” has historically been significant due to the immensity of the sum, the fact that it’s commonly taken as synonymous with great wealth, and its nature as a nice clean benchmark.

2) Your win percentage

This is most important relative to everything else on this list. In binary options, especially under fixed-percentage money management, the win percentage is the most significant component of your trading success.

If you’re under break-even (typically 54%-59% depending on the payout you’re receiving), you will lose money. If you’re just a little above it (e.g., 60%), you will make money, but it will be very slow.

But as soon as you begin approaching 65%, 70%, and above, your profit margin will increase in steepening, nonlinear fashion when under the effects of compounding. Win percentage is key.

3) Daily trades taken

In general, the more trades you take, the faster you can move up the profit latter.

That being said, profit goals should never be the goal when trading. Focusing on money can represent disaster because it triggers primitive emotions like greed and fear, which are absolute anathema to trading well.

In general, one should always trade to trade well. Not to constantly monitor one’s account balance and feel elation to see it elevate and disappointment to see it diminish, or inevitable despondency to see it decrease greatly.

Whether you take one trade per day (maybe zero in some cases) or up to ten per day, it’s essential to make sure that they are good ones. If they are forced, and weaker, low-probability setups, you will inevitably lose money. You can only get lucky for so long.

4) How much time you have to trade

This isn’t an official variable that I have included on the spreadsheet, but in general, the more time you have to trade, the more setups you’ll enter and the more trades you will have the opportunity of taking.

It is perfectly okay if you can’t trade every day or have to take long breaks off during the year. Other life commitments must necessarily come first for part-timers.

I would recommend trading for between 2-4 hours per day. Two hours allows you to perform pre-trading analysis, establish a good focus on the markets, and gives you the ability to watch trades set up in front of you.

When you go over four hours, however, it can start to feel like a grind and focus usually begins to slip. This can lead to some sub-optimal trading decisions, which can quickly erase any hard-earned positive trading results.

5) Percent Risk

The money management method being employed here is fixed-percentage investment – with one caveat. If you invest a fixed-percentage into each trade, that means that each losing trade must necessarily force you to scale down your investments accordingly, as you have less money in your account.

This can make it way too difficult to recoup prior losses. It even artificially inflates your break-even percentage.

By keeping a small investment amount – 2% of your total account balance – and sticking by that amount even during a losing streak or down period, you can continue working toward the goal of growing your account.

Some recommend 1%, which is a great suggestion as well and something I like to employ. It will take twice as long and your trade sizes will be pretty small. But the psychological stress of trading – high enough as it is – will be half as great, as the losses will feel like nothing.

6) In-The-Money (ITM) Percentage

Last on this list is your ITM percentage. One should trade assets you are comfortable in trading first and foremost. But a close second on this is to simply go after trading the assets that provide the highest payout percentage.

Taking low payouts cuts heavily into one’s profit margin, even by taking 80% payouts over 85%. That may seem small, but with the effects of compounding, it can lead to a startling, non-obvious profit difference over time.

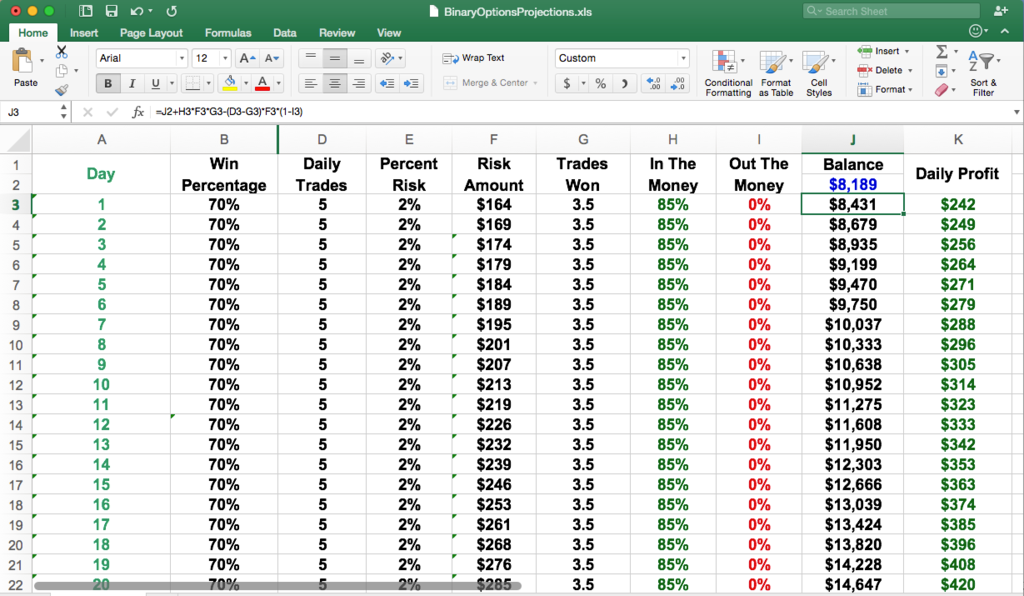

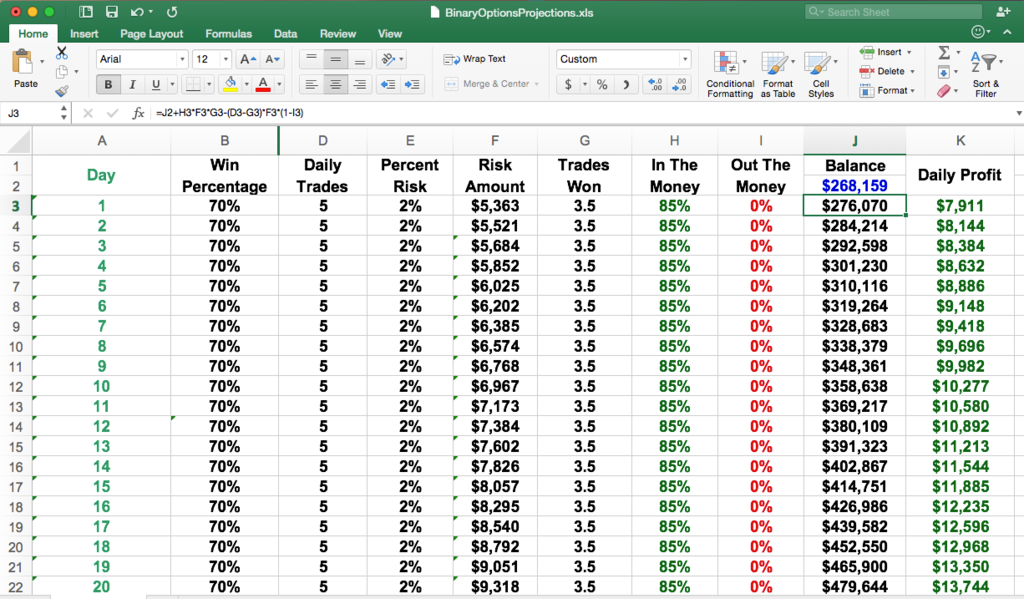

Of these variables, we are going to assume you start out with $250, win 70% of your trades, take five trades per day, invest 2% of your account balance (with no investment-size lowering to account for balance decreases after a loss), and take trades that pay back your initial investment plus 85% of that amount after a winning trade (and 0% for a loss).

So how long might it take you to do this?

Let’s consult our handy spreadsheet that has all these variables programmed into it. (You can download the spreadsheet at the end of this post to fiddle around with figures on your own.)

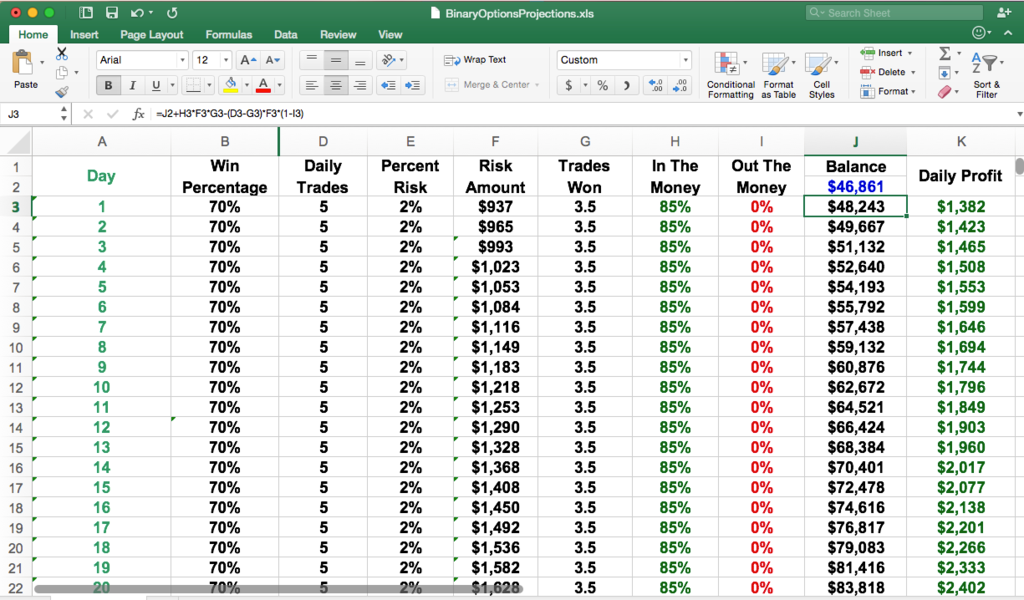

When starting out, profit always comes the slowest naturally. At first we’ll only be making $5 trades. So a winning trade will earn only about $4 and some change tacked onto it, along with returning your initial investment.

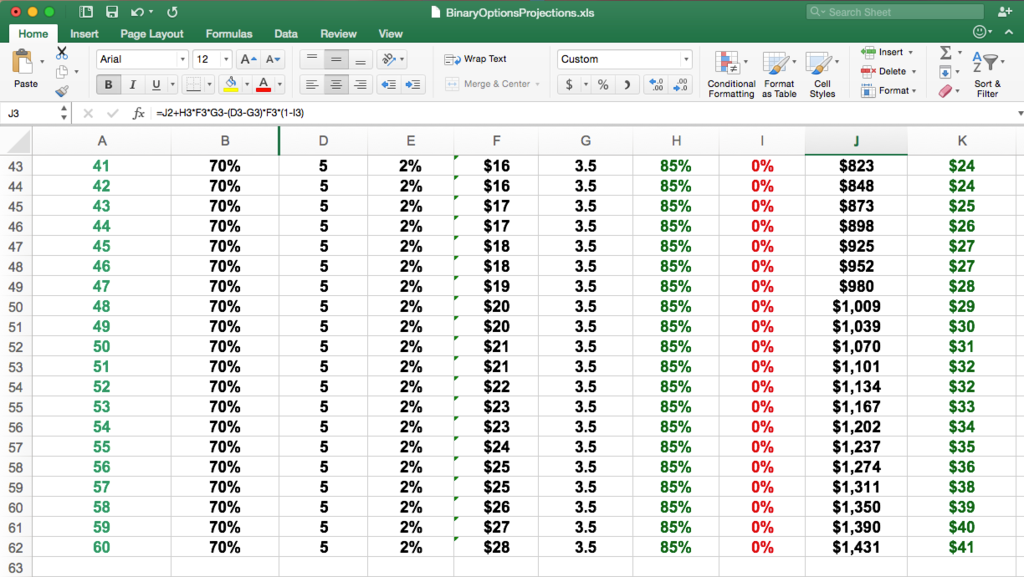

Assume you do this every day for month, which consists of about twenty trading days when the weekends and holidays are taken out. That means 100 trades per month on average, winning 70 of them. After three months, this will leave you with… $1,431. Which truly isn’t bad at all.

That means after these three months – a total of 300 trades and winning 210 of them – you will have a “return on investment” (ROI) of 572.4%. All with a very conservative money management strategy.

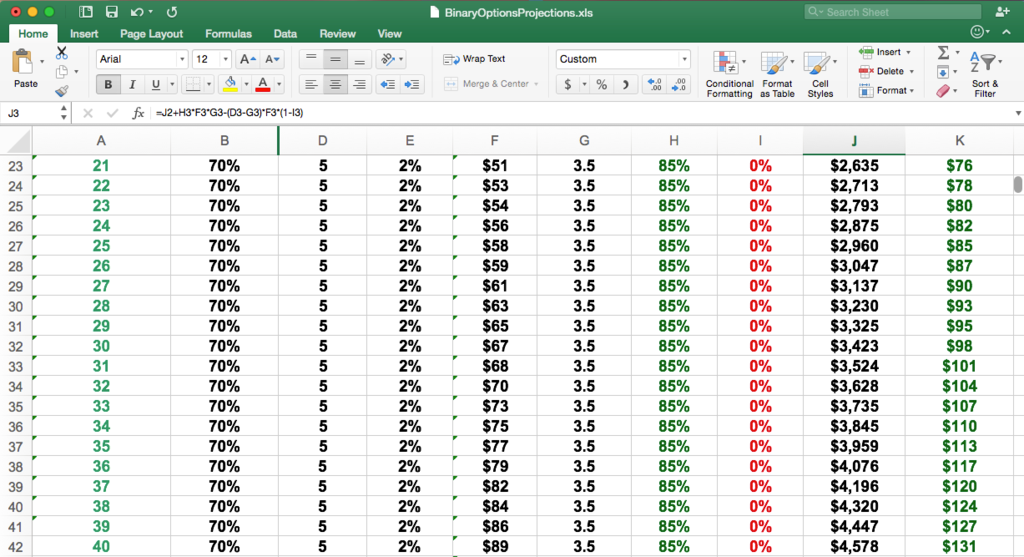

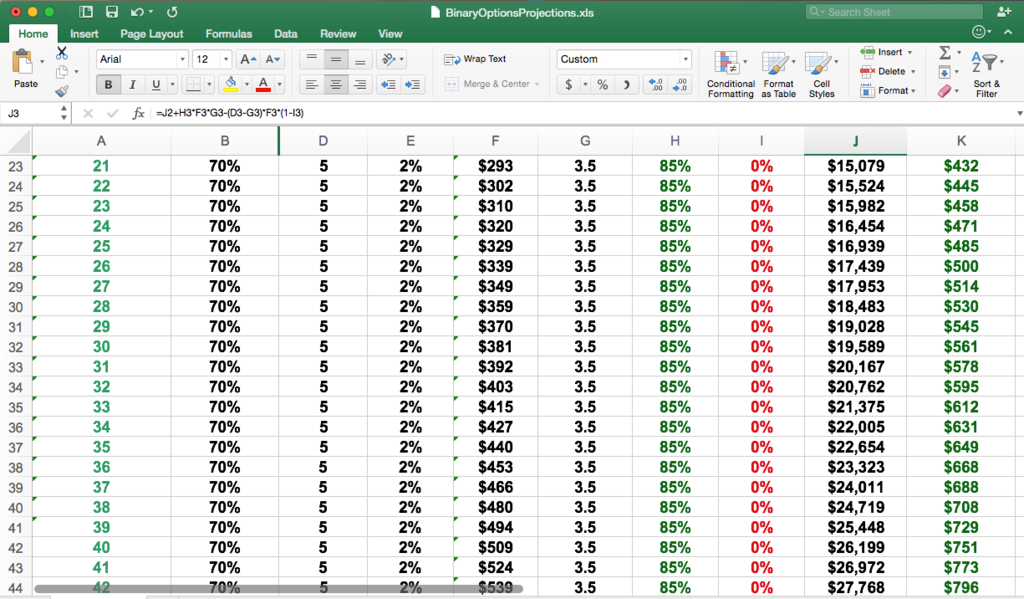

Note that any investment increases are not calculated intraday under this format. Investment sizes are fixed for the day and are based off winning an average of 3.5 trades per day. Every day won’t be equal, of course, but a 70% long-term winning percentage will see everything balance out as expected. Below is a visual rundown of each month on a day-by-day basis.

Month 1

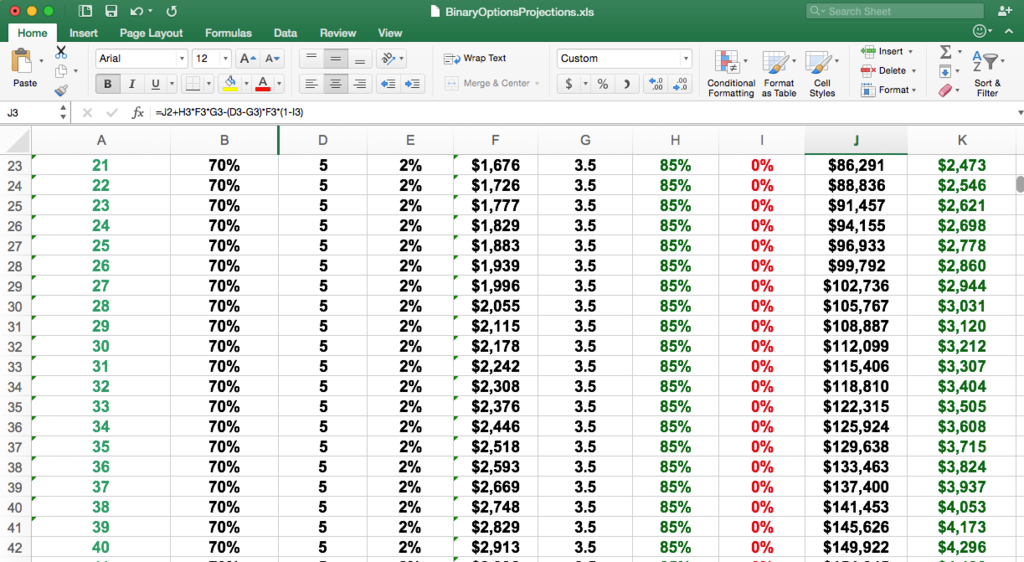

Month 2

Month 3

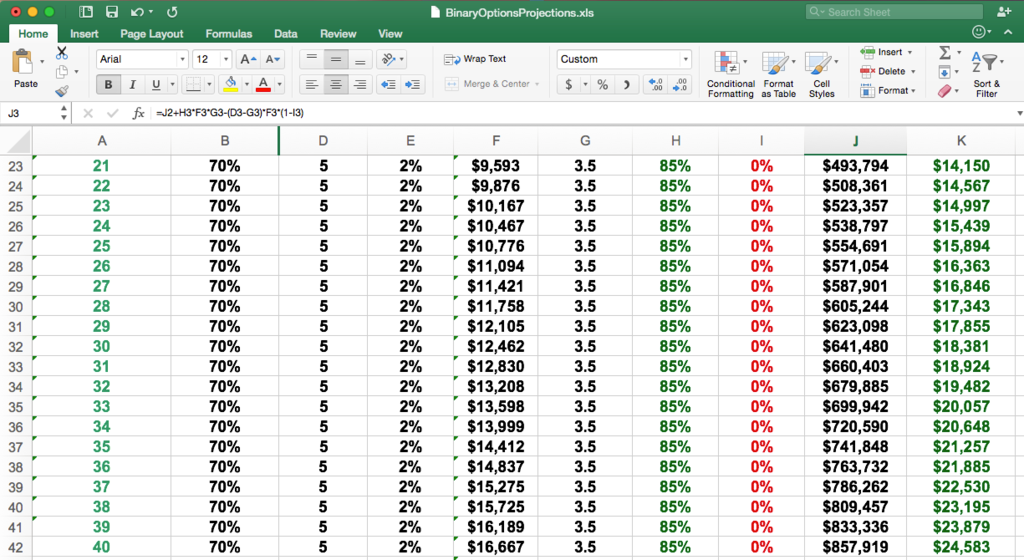

So we take our balance after the third month and plug that back in at the top given our spreadsheet here only goes up to 60 days, or three months worth of trading.

Let’s look at our results for the remainder.

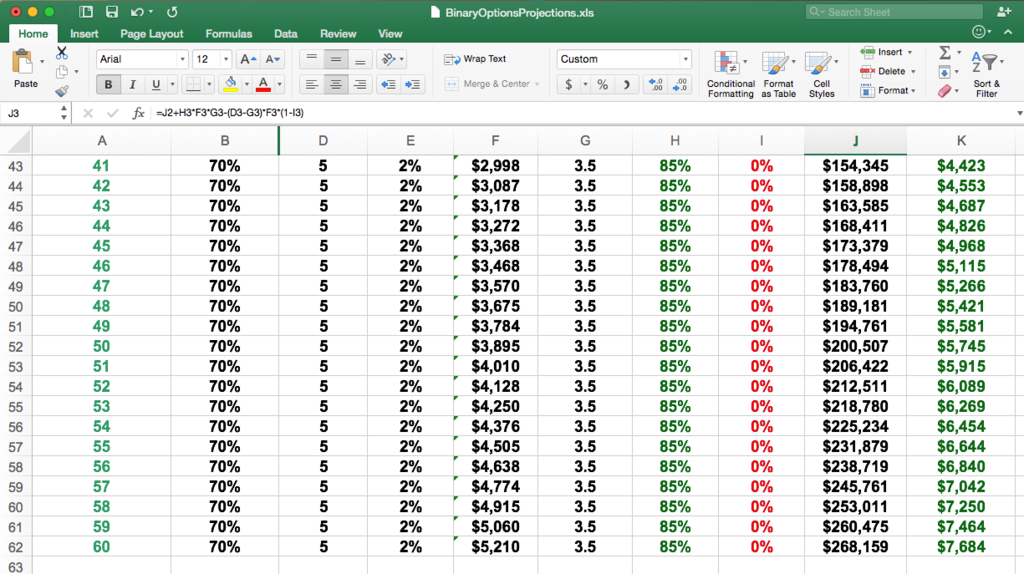

Month 4

By the fourth month we finally have a decent amount of money to work with and begin with a $29 investment size.

By the end of the month – or 100 trades with 70 of them won – you earned $1,229 and have boosted your return ratio to up over a factor of 10.

Month 5

Here we are finally starting to take off, up near the $5,000 mark by the end of it, increasing the return ratio to nearly a factor of 20.

Month 6

By the half-year point, we are starting to earn a profit that is around what an average full-time salary might amount to – $3,611.

Month 7

By the seventh month, you can begin to understand how much a luxury it is to trade with a larger account.

It becomes the point at which you can trade and make a good amount of money doing so without actually taking on any kind of substantial risk. Again, we’re investing just 2% of our balance here.

Month 8

By month eight, the profit nears $13,000 in that month alone (nearly doubled from what it was at the beginning of it).

You now have a couple zero’s attached to the end of your initial investment and then a bit more. The return ratio sits at 111.1.

Month 9

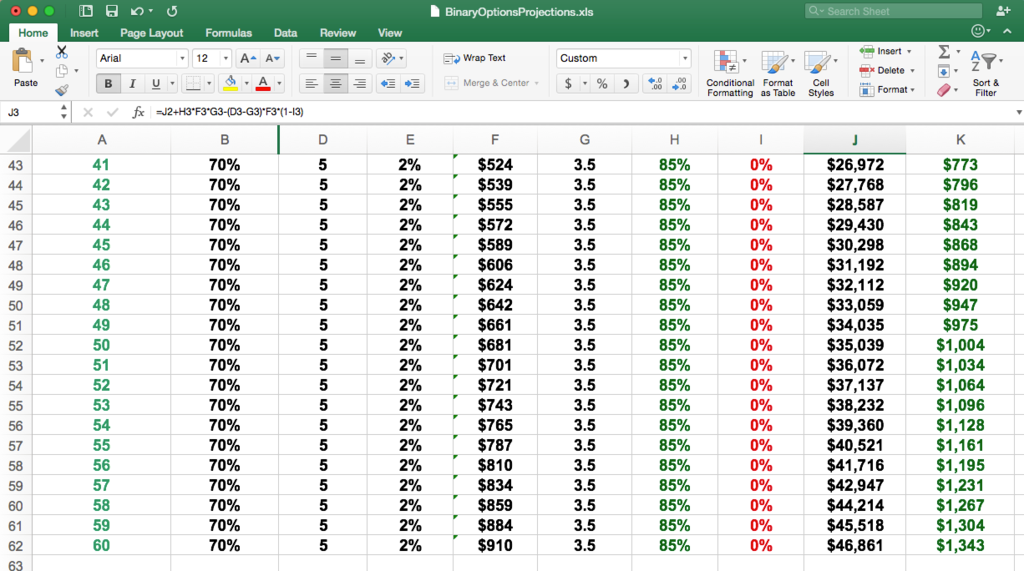

Through month nine, investment size grows rapidly, from $524 to $910, with total profit at $46,861.

Month 10

Even though we are less than 5% of the way from the finishing line by the end of month nine, we are actually a lot closer to the one-million-dollar mark than it seems.

Month 11

By month eleven, we venture over the $100,000 threshold and march up to nearly $150,000.

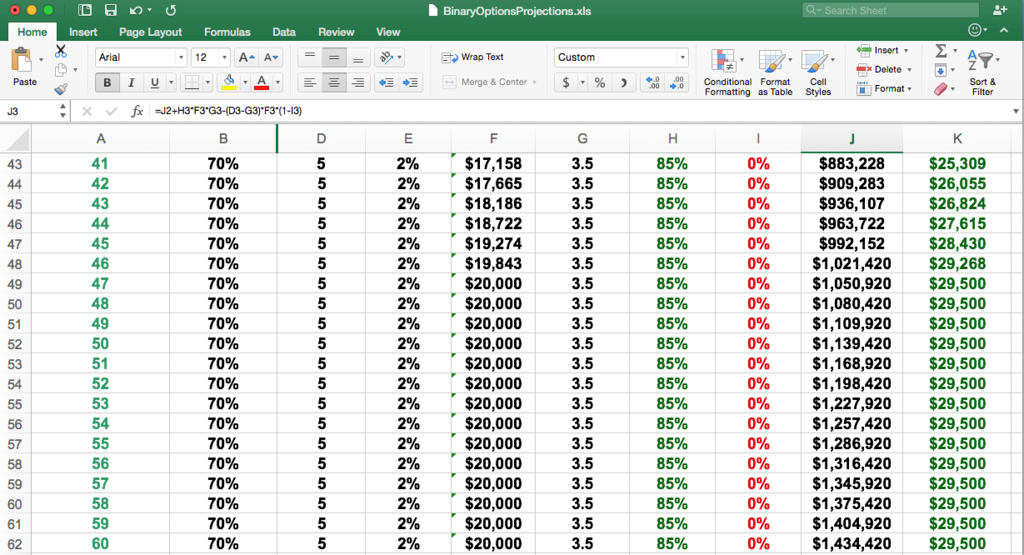

Month 12

At the one-year anniversary, that initial investment sum of $250 is now worth $268,159. That provides a return ratio of 1,073.

Month 13

By month thirteen, we’re right around the half-million mark. About 50% there.

Month 14

Almost there… and notice how high the investment size has grown.

Month 15

And after fourteen months, one week, and one day we finally hit the $1,000,000 threshold. Notice the trade size is capped out at $20,000.

I made this spreadsheet a few years ago back when 24Option had the highest trade investment size among offshore brokers. Some brokers only go up to $1,000 for a maximum trade size. But trust me, if you are just starting out, what broker offers the greatest investment size isn’t something you have to worry about. At least not quite yet unless you turn into one of the very few. 😉

Conclusion

At the end of this, I can never ensure you that anyone will make $1 million from trading. It is very, very difficult. It takes a lot of skill in terms of strategy and adept money management, as well as mastering the psychological and emotional aspect of it, which is truly the most difficult.

Many have the ability to trade from an intellectual standpoint in terms of understanding strategy. It’s the emotional side of it that is so difficult and washes out so many aspiring and established traders.

At its best, this is more of a fun mathematical exercise than anything else. It’s merely to show everyone that this is technically possible.

But its certainly not an easy undertaking to take this blueprint and apply it on one’s rapid ascension up to millionaire status. Usually, the people that make money from trading are those who are doing so from large trading accounts given to them by a large institution under strict oversight.

And with plenty of proprietary tools to help them, even going so far that a lot of it is automated or algorithmic in nature.

Also, I should note that you should never leave large amounts of money in your account. Always don’t leave any money in your account beyond what you need to trade with.

There’s never any reason to have more than $1,000 in an offshore binary options account. Unless you just so happen to be one of the few high rollers who needs that much just to make an individual trade. When I state trading X% of your account balance, it’s truly X% of whatever you have available to use in your trading account.

I always encourage everyone to trade with extreme caution. Never get caught up in how much money you’re making. Things will never go well when thinking about money.

You have to keep yourself as mentally blockaded from the allure of making money as possible. Try to make too much at once and you’ll probably end up with nothing.

Trade to trade well and nothing else. Trading is a very demanding profession that can be mentally taxing and emotionally fatiguing. But if one can master all aspects of it, then it can certainly be very financially rewarding as a result.