For those trading forex – or binary options with currencies as the underlying asset – one decision you’ll have to make is when exactly is the best time of day to trade these markets.

The forex market is open 24 hours per day during the weekdays (excluding holidays). It closes at 5PM EST on Friday and opens back up at that time on Sunday. When you trade makes a big difference. Volume and price movement ebbs and flows throughout the day depending most prominently on simply what hour it happens to be.

For part-time traders, the answer is simple – whenever you have time. However, for those who are more open, there are some important considerations to take account of.

For forex traders, the answer can usually be summed up based on whenever the largest price movements are occurring, as that brings with it the highest earning potential.

For binary options traders, where winning a trade is simply a matter of being on the right side of the fence when the trade expires, the answer to the question can be a bit more nuanced. So I will address both individually.

Best Forex Trading Hours

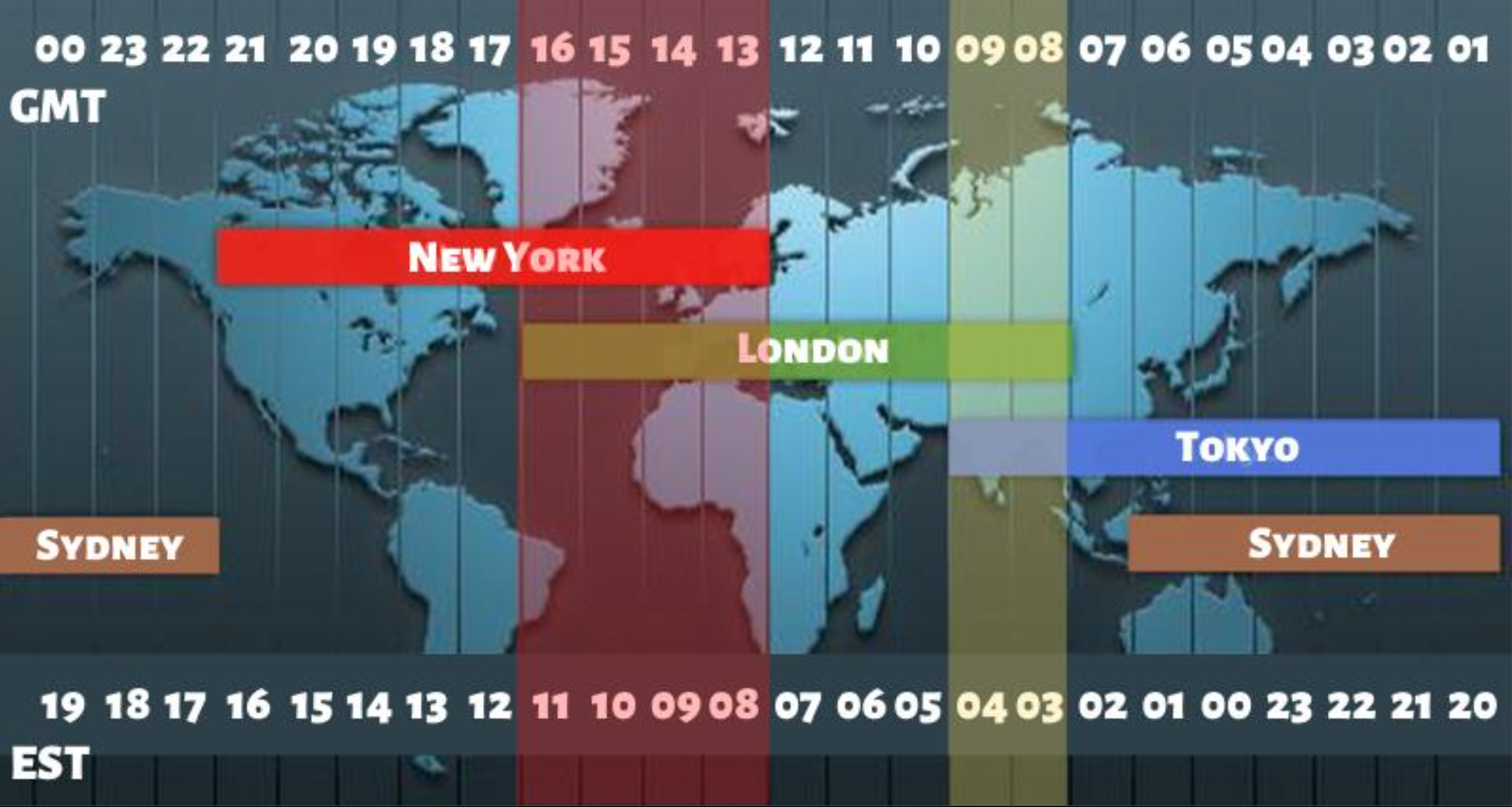

In general, there are three main trading sessions over the course of a day – the Asian session, European session, and North American session. The Asian session produces the least volume, the European session produces the next-most, with the European/U.S. crossover (i.e., when both markets are open at the same time) producing the most.

There are five main forex market centers – Sydney, Tokyo, Frankfurt, London, and New York. They each run from the following hours (in EST):

- Sydney: 5:00PM – 1:00AM

- Tokyo: 6:00PM – 2:00AM

- Frankfurt: 1:00AM – 9:00AM

- London: 2:00AM-10:00AM

- New York: 7:00AM-3:00PM

Based on these hours, you can see the general overlap time between the European and U.S. session occurs from 7:00AM-10:00AM EST, which typically coincides with the highest volume in the market. As such, this is typically a great time to trade forex to take advantage of some of the most significant price movements during the day.

The two-hour late-morning window (from 10:00AM-12:00PM EST) can also provide some good waves, even after the European markets shuts down for the day. Also, you can see some good movement from 3:00AM EST into the New York session when Europe is in full swing.

The Asian session hours are also an option, but you simply won’t see the degree of market movement that you will during the European or North American sessions. Hence the money-making potential isn’t quite as great as it might be.

Best Binary Options Trading Hours

With binary options, the determination of when to trade isn’t as clear as it might be with forex trading. First, as stated earlier, winning a binary options trade is simply about getting the direction of the trade correct. It doesn’t matter if you win by 50 pips or a tenth of a pip, it all counts the same. Consequently, it’s not essential that you trade when the markets have some fuel in them.

But with that said, even if you’re the type of person that likes a slower pace to your trading, I would never trade a dead market. In order to trade well, there has to be some sort of legitimate movement on the asset you’re trading. If the market is going at snail speed and there are minimal cues of any kind to get into a trade, then it’s going to be a challenge to find anything worth trading.

That’s why I’ve personally never really traded from 12PM-12AM EST. I’ve always needed some type of stronger, genuine movement that’s driven by big financial institutions. It’s simply my job as a trader to piggyback on that movement to ideally produce my own winning trades.

For binary options traders, my principal recommendation would be to choose a trading window where there is legitimate movement in the market, but still at the same trading based on your volatility preferences. Based on your trading experience – or demo trading experience if you have still yet to trade – you probably have a good idea of how much volatility you like.

I tend to be more toward the middle of the spectrum. I like slower markets, but not so slow such that there are minimal trading opportunities or barely any sensible evidence to enter a trade.

On the flip side, I don’t enjoy a degree of volatility such that the market is moving so fast that it can be hard to get into trades at your desired price, or even get into them at all. For that reason, I’ve spent a lot of time trading the European session.

My most common trading window has been from 3AM-7AM EST, although I have gone outside of those trading times on occasion. The most important consideration is to trade when you have time. If you have a trading strategy that works, it should work anytime, not merely certain hours during the day.

My recommendations basically fall into three categories for binary options trading times:

Asian session

For those who want a calmer market. Getting into trades at the price you want shouldn’t be too difficult during the Asian session. The downside is that there might be fewer trading opportunities, and sometimes the market is so slow it’s borderline yawn-inducing. However, for many in the U.S., this can be a good session to trade in the typical “after work” hours being Sydney and Tokyo overlap from 6:00PM-1:00AM EST.

Trading currency pairs that include the AUD (Australian dollar), JPY (Japanese yen), or both (the AUD/JPY), could work well, given both will be experiencing pretty good levels of volatility when their respective markets happen to be open.

European session

For those who prefer moderate volatility. The European session provides a good balance of market volume while still not being super volatile as a whole.

The European market doesn’t really start to heat up until both Frankfurt and London open at 2AM. Currency pairs that have a European component tend to be best to trade during this time (e.g., EUR/USD), as opposed to ones that don’t (e.g., USD/JPY).

European/US crossover

For those who like fast, active markets, going for the period when the European session overlaps with U.S. morning activity is a good way to go.

There will normally be plenty of trade set-ups to consider during this period, with support and resistance being tested and strong moves along the way. The world’s most popular currency pair, the EUR/USD, normally sees its peak level of activity during this period.

The market is also regularly driven by news releases during this period, so that also has to be considered. Normally, the biggest releases come out at 8:30AM EST and can drum up a high level of volatility that isn’t very well suited to those who trade exclusively based on technical analysis, so that is one thing to consider.

Conclusion

There are many valid times to trade the market and the foremost among those is simply whenever you have the time available to carve out of your daily schedule. However, for forex, where gaining as many pips as possible is the goal, trading during strong price moves is an important consideration.

Hence, the European and/or US sessions would be strong considerations. For binary options, where predicting which direction the asset will move by a certain time is the primary focus, market volume is less important.

Regardless, picking a time window to trade that fits your volatility preferences while providing some genuine market action to work with can boost your results by better matching your trading to your own individual personality.