Learning how to trade options offers a way to profit from the equities market without having to buy the associated stocks directly. Unlike with basic buying and selling stocks, using options to trade the financial markets limits your risk and offers strong profit potential that simply wouldn’t be available if you were to trade the price movements with stocks alone.

Moreover, with options you can profit without even necessarily taking a specific position with respect to where the price of the underlying asset might go.

Hence you could profit even if the stock were to go sideways.

The following list provides three basic options trading strategies that you can employ to profit from the market based on three typical trading scenarios – when you anticipate the market to go up, down, or potentially break out of a consolidation pattern regardless of the direction.

These options trading strategies offer some of the fundamental basics that are employed from beginners through those who make a living trading options.

Table of Contents

1. Bullish Strategy

If you expect a stock to increase in price, the common options strategy would be to buy a call option. Your risk in this case is limited to the premium that you pay for the option.

In stock trading, you would be forced to buy the actual stock at its given price. This, of course, can be expensive, puts oneself at full risk, and can even be less profitable even if you are correct in your prediction.

Example

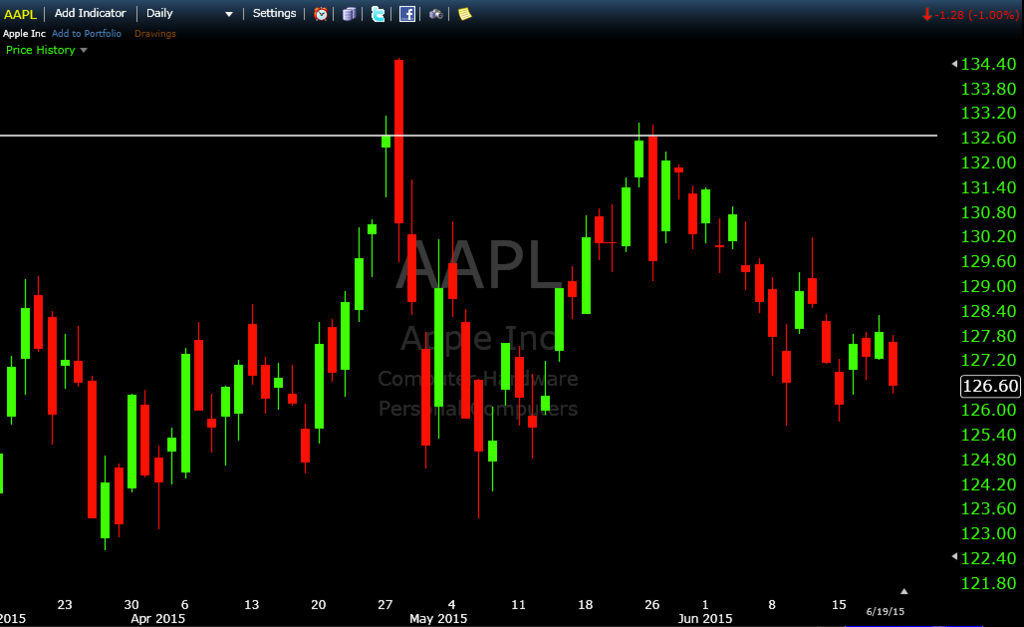

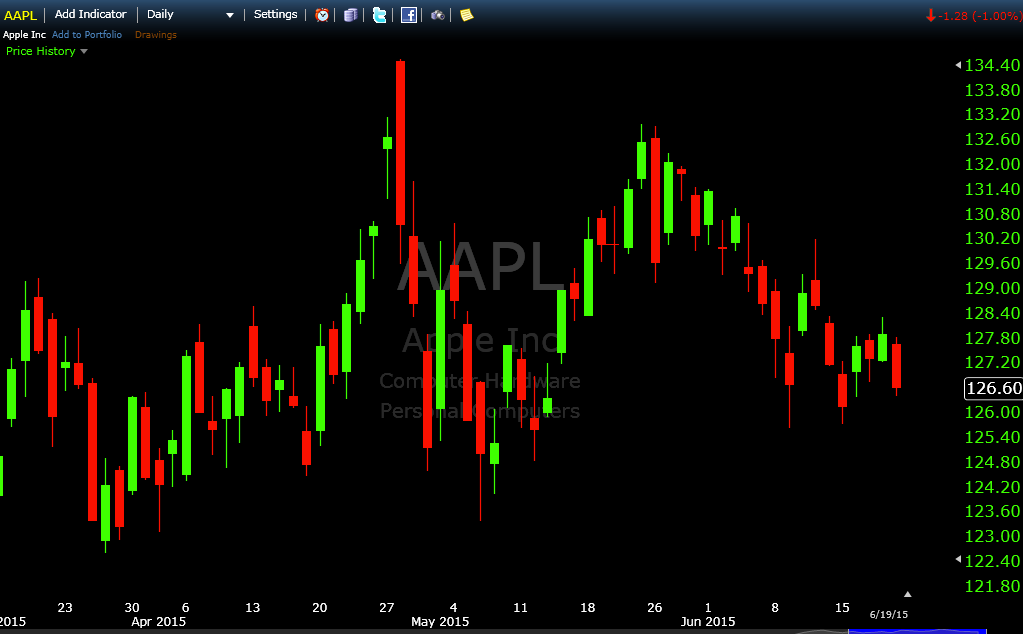

Let’s say you take a look at a daily chart of Apple (AAPL) and see a support line at roughly 124.80, and decide to buy a call option just below at 124.00. And say you get into this trade (i.e., buy the 124.00 call option) when it’s trading at 127.00.

As a technical trader, this might seem like a good trading opportunity. The option is in-the-money, the stock is in a multi-month uptrend, and it will have to move down to breach a support level before expiration. The odds are in your favor of this trade working.

Assume you buy the 124 call for a premium of $3.00. Since 100 shares are inherent in each options contract, this would be a $300 investment. If this option lands in-the-money, you would have the right (but not the obligation) to buy these shares at your original strike price (127) and sell them for the current price.

If at expiration, the stock is selling for 129.00, your option sits in the money by 5.00. This would provide a $500 gain when you exercise your right to buy the stock and immediately sell them for profit. Since you paid $300 for the premium, this would provide a $200 ($500-$300) profit.

Summary

Paid $300 for the premium.

Gained $500 for the option’s worth at expiration.

Made a net profit of $200.

2. Bearish Strategy

If you expect a stock to decrease in price, then the standard strategy is to buy put options. Like in the bullish strategy mentioned above, your risk would inherently be limited to what one pays for the premium.

Example

Based off AAPL again, a strong resistance level forms just shy of the 133 level. And let’s assume you get into this option at a price of 127. As such, you feel it’s unlikely for AAPL to break through this resistance level and land out-of-the-money by expiration.

As a consequence, you buy a put option at the 133 level for a premium of $6.00. Again, because there are 100 shares included in each options contract, the total investment would come to $600.

If you are correct and AAPL does move down in price to some extent, then your profit will be the difference between the final price and strike price (the absolute value) minus what you paid in premium.

If at expiration AAPL was trading at 123, then your profit would be 100[(133.00-123.00)-6.00], or $400. We took the difference between the strike price (133) and final price (123) minus the initial premium of the options contract (6) and multiplied by 100 to account for exercising your right to buy the shares at the strike price and sell at the current price.

Summary

Paid $600 for the premium.

Gained $1,000 for option’s worth at expiration.

Made a net profit of $400.

3. Betting on Volatility, but not Direction

Trading options also provides the ability to trade volatility itself, rather than placing a particular prediction on the direction of the underlying asset. This is due to the nature of options themselves, as volatility is directly priced into the premium.

The premium that is paid to purchase an options contract is based on several components, including the underlying price of the asset, the strike price, implied volatility, time until expiration, dividends, and interest rate.

Options strategies that invest based on volatility, but not direction, are deemed straddles. In this case, two transactions need to be made to cover each direction.

To yield a profit on straddles, price must break out of a certain boundary by expiration. But the positive aspect is that you won’t need to predict a specific direction in order to profit.

This could be a beneficial tactic during earnings season or during a tight congestion pattern on a price chart, which typically precedes a breakout.

Example

Volatility on AAPL is low and has been undergoing a period of congestion over the past week of trading on this chart. In this case, you will want to buy both a call and put option as close to the strike price as possible to employ a straddle strategy.

Say you get into the trade at 127.00. You would buy a 127 put and also a 127 call. Since premium is highly contingent on underlying price’s relative proximity to the strike price – with a smaller spread between the two yielding a smaller premium – you won’t have to pay a high premium as you would with a significantly in-the-money option.

The total premium for both might likely be somewhere around $1.00 for the total contract ($0.50 for both the buy and sell) – or $100 for the total investment (100 shares multiplied by $1.00 per share). But it depends on how close to the expiry it is. For options that have a month before expiry, the premium will be higher.

For options that are a few days from expiry, the premium will be lower. Low-premium options close to an earnings reports would generally provide a strong risk-to-reward scenario for a straddle type setup. But due diligence must be taken with respect to each individual situation.

If you enter the trade at 127 and by expiration it sits at 131, that call option would now be worth $400 due to the 4.00 rise in price. The put option would be worth nothing as it expired out-of-the-money.

That would provide a total profit of $300 ($400 gain minus the $100 premium) based on the volatility of the asset alone. Even if the asset fell by an equal amount from the strike price (i.e., from 127 to 123), the profit would be the same.

Based on the premium paid, if the option expires at a price outside of the 126-128 range, a profit will be made. A partial profit would still be made on one of the two options, unless both finished exactly at 127, finishing precisely at-the-money.

But even under this worst-case scenario (no volatility), the risk is already pre-defined at the $100 premium that was paid. But the profit potential is unlimited. The further the stock deviates from the strike price, the more the straddle investor profits.

Summary

Paid $100 for the premium.

Gained $400 for option’s worth at expiration.

Made a net profit of $300.

Conclusion

Options provide an excellent of means of trading stocks, either in the form of predicting direction or by taking a stance on the underlying volatility itself, depending on the trading strategy employed.

Moreover, the risks with options trading are predefined and relatively small in comparison to the inherent risk undertaken when buying or shorting stock outright.

If you buy 100 shares of a $50 stock and that company goes under and its shares plummet, you would be responsible for that $5,000. On the other hand, by buying a call option at some level of premium, you would be responsible for a fraction of that.

If you buy an in-the-money call option at a price of 45 (while it’s trading at 50), for example, pay $300 in premium, and that stock increases to 52 by expiration, you would earn that $700 (difference between the strike and expiration price multiplied by the 100 shares for each options contract) minus the premium. That gives a net profit of $400.

If you were to buy the shares outright at the price they’re trading at (50) and sell later at 52, that gives a profit of just $200, with no predefined risk. You could employ a stop-loss, but that provides little wiggle room for a trade to develop. With options, risk is already inherently built in.

And that’s why so many people enjoy trading options.